stag stock dividend growth rate

MAR 31 0500 PM EDT. Dividend history for stock STAG STAG Industrial Inc including historic stock price dividend growth rate predictions based on history payout ratio history and split spin-off and special.

Stag Industrial Inc A 3 8 Yielding Reit That Benefited From The Pandemic Nyse Stag Seeking Alpha

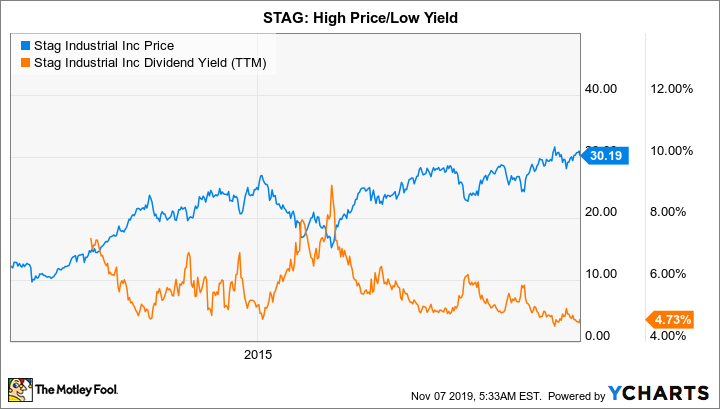

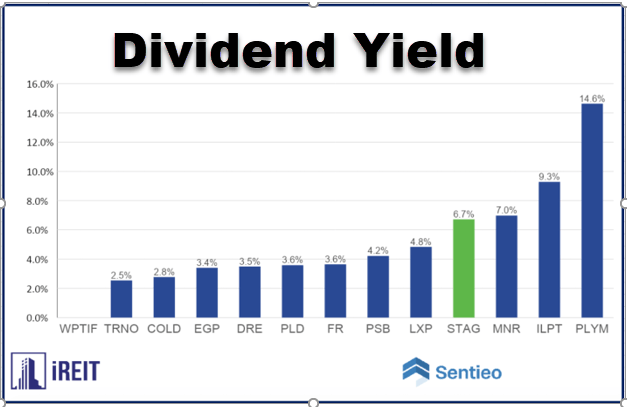

The forward dividend yield for STAG as of Feb.

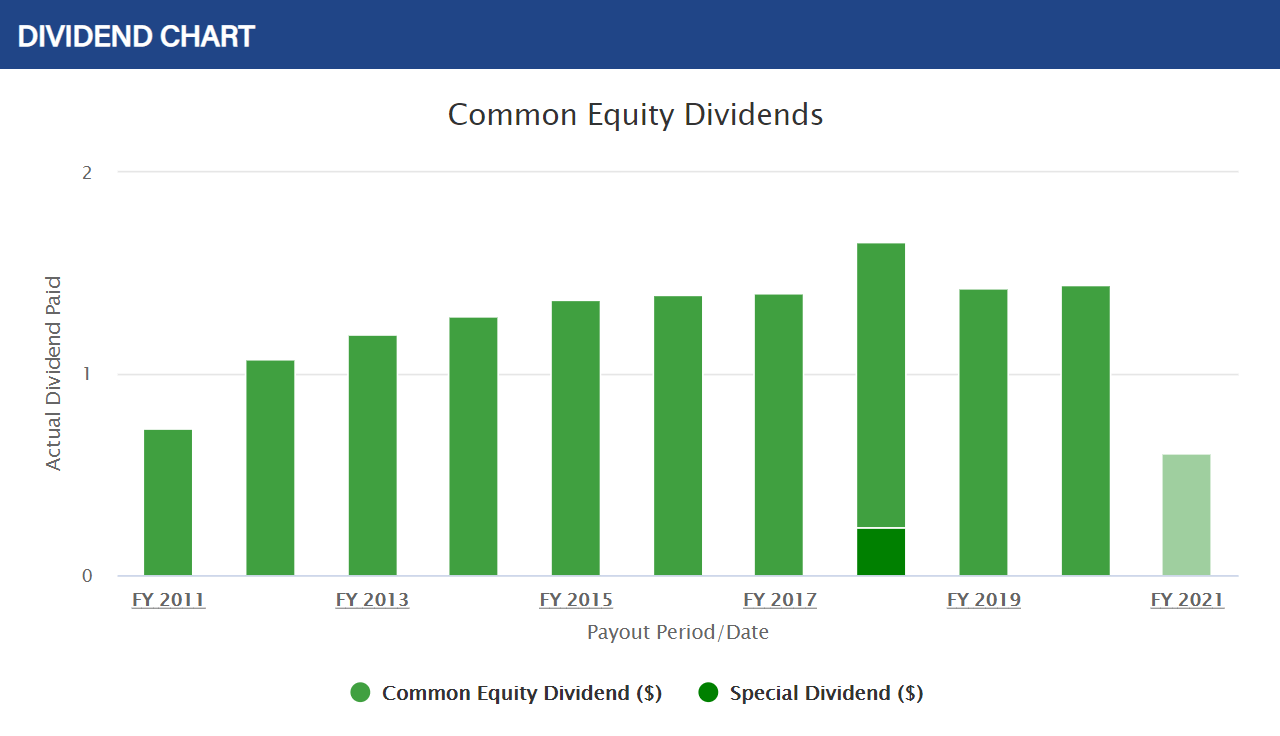

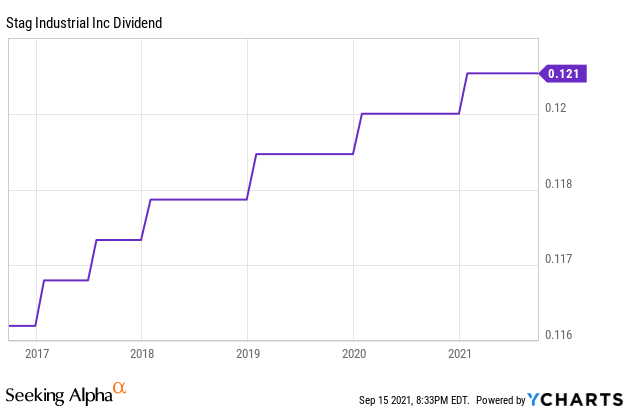

. Moreover the company has increased. So STAG is very specifically a dividend stock -- and dividend growth has been miserly. The lowest was 080 per year.

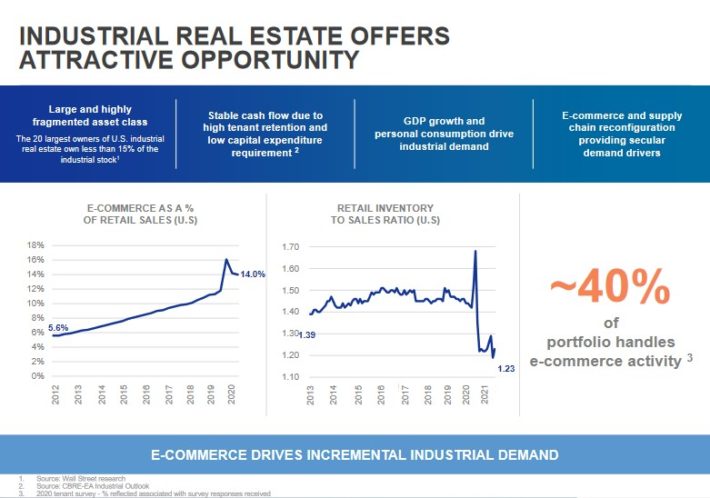

As it holds a 43 compound annual dividend growth rate since 1994. Stag STAG delivered FFO and revenue surprises of -192 and 039 respectively for the quarter ended December 2021. That doesnt even come close to the roughly 3 historical rate of.

And the median was 290 per year. The table below shows STAGs growth in key financial areas numbers in millions of US dollars. Year 2 Growth Rate 105 100 - 1 5.

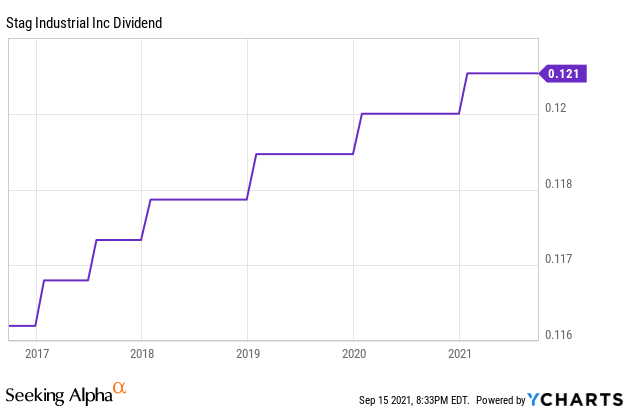

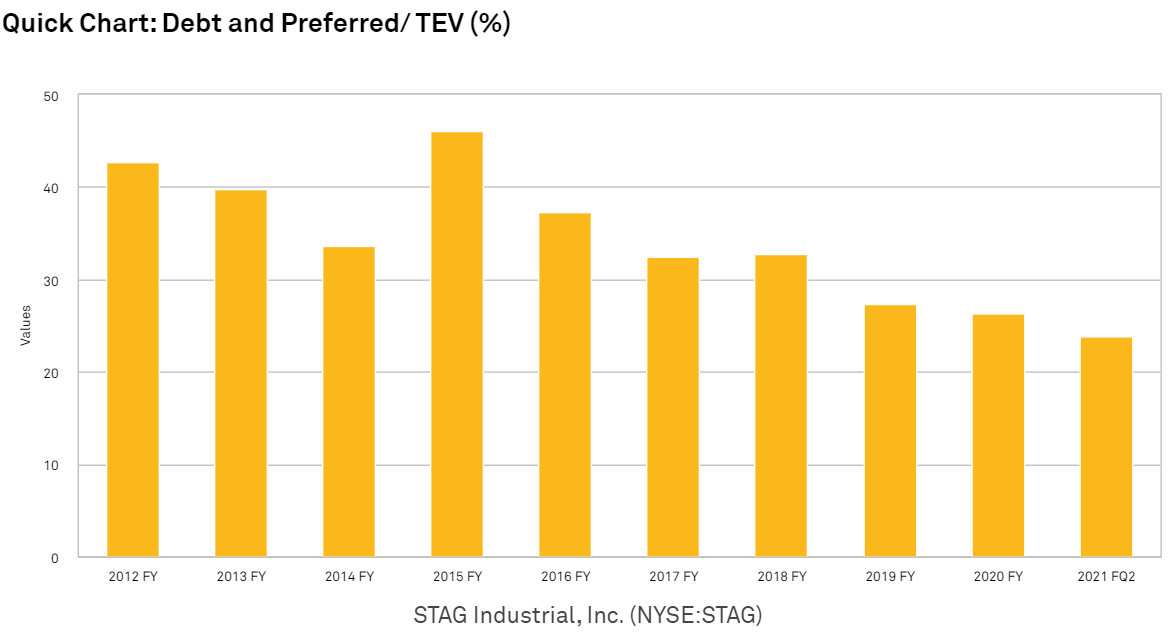

Average dividend growth rate for stock STAG Industrial Inc. STAG used to rely heavily on purchased growth. STAG - Dividend Growth.

I am thinking about trimming my position locking in the gains and putting the proceeds into a stock that grows their dividends by an amount more in-line or above inflation. 1 year growth rate TTM. STAG for past three years is 084.

Bottom-line grew by 50 from the second quarter. The most recent annual dividend increase was less than 1. 10 Best Monthly Dividend Stocks to Buy for 2022 10.

13 rows STAG Dividend Growth Rate. This pace of advancement corresponds to an average growth rate of 55 per year. Its 5 year net income to common stockholders growth rate is now at 45416.

11 2022 is 365. On this page we examine the STAG dividend growth over time. NYSESTAGs 3-Year Dividend Growth Rate is ranked higher than.

Year 1 Growth Rate NA. Do the numbers hold clues to what lies ahead for the stock. Tue Feb 15 907 AM Zacks.

STAG Industrial has offered its shareholders dividend hikes every year since the REITs inception in 2011. Stag Industrials Dividends per Share for the three months ended in Sep. During the past 13 years the highest 3-Year average Dividends Per Share Growth Rate of Stag Industrial was 2110 per year.

The problem here is dividend growth. If you are buying STAG you are most likely doing. Over the past 33 months STAGs revenue has gone up 193494000.

Year 4 Growth Rate 111 107. 15 Feb 2022 Tue 15 Mar 2022 Tue Forecast Accuracy. 12 rows Start your Free Trial.

Good morning I own some STAG yield is good but the growth rate has been only 1 a year for several years. Stag STAG delivered FFO and revenue surprises of -192 and 039 respectively for the quarter ended December 2021. 20 Year Annualized Growth Years Of Consecutive Dividend Growth 069 211 432 9981 0 9.

STAG dividend gowth summary. Ad Ex-Dividend Dates Dividend Calendar All-Star Rankings Special Divs More. The dividend yield is calculated by dividing the annual dividend payment by.

57 of the 532 Companies. 3 5 10 year growth rate CAGR and dividend growth rate. Average yearly income per share growth for Stag Industrial Inc is 172 while S P 500s average annual income per share increase is 183 over the five years including only Businesses with the third quarter 2021 earnings reports.

Do the numbers hold clues to what lies ahead for the stock. STAG used to buy at 8 caps and now the available properties trade for 5 caps. Our premium tools have predicted STAG Industrial Inc with 100 accuracy.

In the above example the growth rates are. Over that period the trust enhanced the total annual dividend payout amount 53. Cap rates have fallen across most REIT property sectors but particularly in industrial.

NYSE Stock STAG Industrial Inc - 6875 PRF PERPETUAL USD 25 -. Year 3 Growth Rate 107 105 - 1 19. Dividend history for stock STAG STAG Industrial Inc including dividend growth rate.

They were the high cap rate industrial REIT and grew for their first decade as a public company by playing the spread game. Its 4 year net income to common stockholders growth rate is now at 45416.

Is High Yield Stag Industrial A Buy The Motley Fool

Stag Industrial Stag Monthly Dividend Safety Analysis

Is High Yield Stag Industrial A Buy The Motley Fool

Stag Industrial Stock Dividend Growth Ahead Nyse Stag Seeking Alpha

Stag Industrial Stock Dividend Growth Ahead Nyse Stag Seeking Alpha

3 Dividend Stocks That Pay You More Than Pepsi Does The Motley Fool

Stag Industrial A Monthly Dividend Machine At A Premium Price Nyse Stag Seeking Alpha

Stag Industrial A Monthly Dividend Machine At A Premium Price Nyse Stag Seeking Alpha

Stag Industrial A Cash Flow Is King Pick Nyse Stag Seeking Alpha